Health Insurance Potentials and Pitfalls; Navigating Open Enrollment

My dear partner in crime to the North, Marijke, has been able to stay out of the fray of a strictly American tradition that befalls many US residents each fall/winter. No, I am not talking about Black Friday. That big shopping day has already hit our Canadian neighbors. I am talking about the yearly rite of passage known as Open Enrollment for health insurance. Typically there is a limited time period in autumn when many of us sit down with our calendar, pile of insurance bills, family members, and mind-calming music to tackle the challenges of reviewing current insurance coverage. Open Enrollment is usually the only time to make changes to your insurance coverage. Exceptions do exist like the birth of a child or marriage.

Open insurance enrollment is the designated period when you can make changes to your health, life, or other forms of coverage. You may need or want to change because you changed jobs, got married or divorced, or welcomed a new child into your family. You can enroll in a new plan, make changes to existing coverage, or switch between different plans offered by your insurance provider. Understanding the nuances of open enrollment is crucial for making informed decisions about your insurance needs. Let’s review some important issues to consider.

Open insurance enrollment is the designated period when you can make changes to your health, life, or other forms of coverage. You may need or want to change because you changed jobs, got married or divorced, or welcomed a new child into your family. You can enroll in a new plan, make changes to existing coverage, or switch between different plans offered by your insurance provider. Understanding the nuances of open enrollment is crucial for making informed decisions about your insurance needs. Let’s review some important issues to consider.

Key Issues to Consider

- Coverage options

- Policy costs

- Life changes

- The general health of you and your loved ones/dependents.

- Will the health plan cover your provider?

- Will the health plan cover your medications?

Coverage Options

During open enrollment, it is mission-critical to take the time to evaluate the various insurance plans available. Consider your current health needs, financial situation, and any anticipated life changes. For example, some insurance options exclude maternity care. Or if you know that you may be in need of a hip replacement in the following year, you may also want to adjust your coverage accordingly to accommodate an expensive procedure. If you are young and healthy and not taking regular medications, you may want to plan for catastrophic care in case you are hospitalized. Take the time to assess whether your existing coverage aligns with your requirements or if adjustments are necessary.

Premiums, Deductibles and Copayments

It is really important to understand the financial aspects of your insurance plans, including premiums, deductibles, and copayments (also known as copays). Evaluate how these costs fit into your budget and whether you need adjustments to better align with your financial goals.

The amount you pay on a regular basis (typically monthly) for insurance coverage is the premium. The size of the premium can vary depending on the number of many family members and how many services.

I have 3 types of deductibles, what does it all mean?

A deductible is the total amount of money that you are expected to pay “out of pocket” (your own piggy bank) before your insurance coverage kicks in. For example, if you have a $3000 deductible, you are expected to pay the first $3000 of covered services until the insurance begins to pay. Typically, you will NOT have to pay for preventive medicine/well-person visits or some vaccines. Some plans may have a separate deductible for prescription medications. And some programs may break down a family plan and have a deductible for each person covered under the plan.

Some plans may also refer to a copayment. After you have paid your deductible for the year, then you may have a copay for additional access to medical care. This is the amount you will pay along with your health insurer for a medical visit. It is usually a fixed amount, like $30 each time you access the service (like a physical therapy appointment).

It’s a girl!

If you’ve experienced significant life changes, such as getting married, having a child, changing jobs, or a change in health, these events can impact your insurance needs. Ensure that your coverage adequately reflects these adjustments to avoid any gaps in protection. Typically your insurer will allow you to enroll at the time of the child’s birth (even if it is not in the enrollment window). However, you may want to expand coverage as you ponder the number of provider visits that will be needed for the new tyke as they battle runny noses, spit up, and more.

If you’ve experienced significant life changes, such as getting married, having a child, changing jobs, or a change in health, these events can impact your insurance needs. Ensure that your coverage adequately reflects these adjustments to avoid any gaps in protection. Typically your insurer will allow you to enroll at the time of the child’s birth (even if it is not in the enrollment window). However, you may want to expand coverage as you ponder the number of provider visits that will be needed for the new tyke as they battle runny noses, spit up, and more.

Alphabet soup: Different market plans: HMO, PPO, EPO, POS…

Do you have an HMO plan?

A health maintenance organization (HMO) plan is usually a self-contained insurance entity where you agree to only get care within the group of providers, specialists, and hospitals listed by the health maintenance organization. You typically will not be offered the coverage unless you live or work in its service area. For example, Kaiser is a large HMO in certain areas of the U.S. that expects you to access their hospitals, clinics, and specialists when you enroll in their HMO. In general, it will not cover when you access care outside the group. However, if you are traveling and not near a Kaiser facility, you are expected to call the toll-free number and notify them of your need for care.

Similarly, an EPO (exclusive provider plan) will cover the cost of doctors or services within their network only. A Point of Service (POS) plan, similar to an HMO, allows you to pay less if you see certain providers within the plan. Most often for an HMO or POS, your primary care provider will need to write a referral for you to see a specialist.

Is there an advantage to a PPO plan?

A Preferred Provider Plan (PPO) allows you to access a set of specialists, hospitals, and clinics within the insurance network typically without a referral from a primary care provider. Usually, they are more expensive than an HMO plan, but they provide the flexibility of not requiring a primary care referral.

A Preferred Provider Plan (PPO) allows you to access a set of specialists, hospitals, and clinics within the insurance network typically without a referral from a primary care provider. Usually, they are more expensive than an HMO plan, but they provide the flexibility of not requiring a primary care referral.

Will my plan cover Wegovy?

If you regularly take prescription medications, verify that your chosen insurance plan covers these medications (especially medications that are brand name, under patent, and therefore, often much more costly), and assess any changes in drug formularies (the lists of drugs). Consider the impact on your overall healthcare costs.

What if I am young, super healthy, and only see my doctor for my Pap smear?

Consider a Catastrophic health plan if you are very healthy and may engage in a bit of thrill-seeking and potentially life-threatening adventures on the weekend. (There is a reason that emergency medicine physicians often refer to motorcycles as “donor cycles.”) It doesn’t matter how talented YOU are as a motorcyclist when everyone around you is encased in a 2-ton killing machine that may drive unpredictably. Catastrophic health plans are only available to people under 30 or people over 30 who apply for a hardship or affordability exemption. They have much lower monthly premiums, very high deductibles, and will only kick in after you have paid your entire deductible amount.

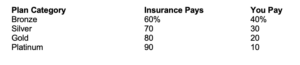

Bronze, silver, gold, is this the Olympics?

Some companies list insurance plans by how much they cost and what they cover. Bronze will have the lowest monthly premiums, but the highest costs when you need care. This is great if you are relatively healthy and the plan will cover you for “worst-case scenarios.” You pay the most out of the options for routine care. Usually, the premium will increase as you go up from Silver to Platinum. The costs when you access care decrease. If you require regular care and have a complicated medical history, platinum may be a great option for you. And yes, this is even more complicated! You may be eligible for a deduction based on your income and some employers may subsidize further if you pick Silver or higher.

Wellness Programs:

Some insurance plans offer wellness programs and preventive care benefits like yoga classes, mental telehealth access, physical therapy, or chiropractic care. Explore these offerings to proactively manage your health and potentially reduce long-term healthcare costs.

Time to ponder life and the afterlife

If you have had a child or have become the sole income earner in your family, you may want to also adjust your life insurance coverage in the sad but possible event that you die. What amount of money could protect your family in the event that this happens? Also, check that you have included that new bundle of joy as one of your beneficiaries if you so desire.

If you don’t enroll, you may not have coverage for the following year!

This is probably the most expensive, aggravating, yet necessary piece of adulting that you do EVERY year. Much as you plan ahead for family vacation, make sure to set aside a time to review this. And don’t forget the financial clock returns to zero on January 1 for your policy.

So before you plan your vacation for next year, do a day of “adulting” and potentially save yourself thousands of dollars in medical bills. It will be worth it. You can reward yourself with a nice bowl of ice cream, movie theater popcorn, or dinner with friends afterward. Here is a calculator you can use to help you determine which plan might be best for you.

Disclaimer

The information in this blog is provided as an information and educational resource only. It is not to be used or relied upon for diagnostic or treatment purposes.

The blog does not represent or guarantee that its information is applicable to a specific patient’s care or treatment. The educational content in this blog is not to be interpreted as medical advice from any of the authors or contributors. It is not to be used as a substitute for treatment or advice from a practicing physician or other healthcare professional.